Every year in Switzerland, the cantons receive a share of the net profit from the taxation of spirits, i.e., the so-called alcohol tenth (10% of the profit goes to the cantons; 90% goes to the federal coffers). In 2022, CHF 28'158'963 went to the cantons in relation to their populations.

The cantons are obliged to use their share of the alcohol tenth to combat the causes and effects of alcoholism, as well as the abuse of addictive substances, narcotics and medications. After the money has been distributed to the umbrella organizations, these report to the Federal Office for Customs and Border Security, Alcohol, about the use of the alcohol tenth.

These reports can be found on the corresponding page by clicking on the desired canton on the map of Switzerland.

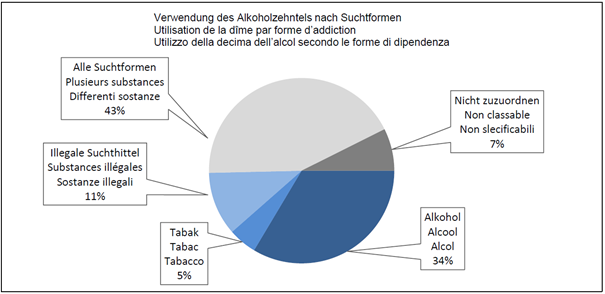

Use by addiction type

The use of the alcohol tenth by addiction type shows that she is reserved not only for preventing and addressing the problems arising from alcohol dependency, because alcohol is no more the most beneficiary from alcohol tenth with a rate of 34% (one percent less than the previous year). In terms of figures, it was just a little more than CHF 9 million in 2022. However, almost all cantons use some of the alcohol tenth for alcohol issues.

It should also be noted that a considerable proportion of the alcohol tenth is allocated to general purposes aimed at combating various forms of addiction. In fact, in 2022, 43% of cantonal expenditure was allocated to various substances combined.

In general, around 11% of the money goes to combating the causes and effects of the consumption of illegal substances, and around 5% goes to tobacco control. These percentages have not changed over the past 10 years.

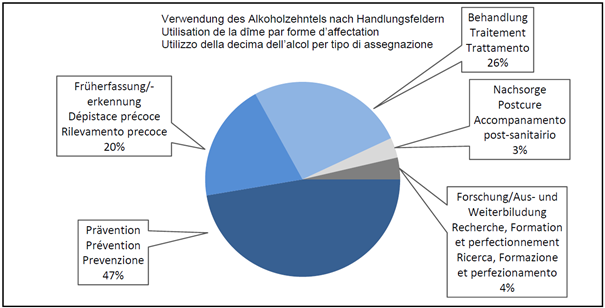

Use by action field

The cantons usually invest over 90% of the alcohol tenth in prevention, early detection and treatment. The shares that go to follow-up care, research, training and continuing professional development are generally around 10% (7% in the actual case).

Over the years, there has been great stability in its use in the areas of prevention, follow-up care and research. At 20%, early detection has seen a slight increase of 2% compared with 2021. In general, the allocation of funds depends largely on the strategy of the individual cantons.

The reports show the importance of the alcohol tenth in financing the cantons' prevention, early detection and treatment.

Contact

Federal Office for Customs and Border Security FOCBS

Alcohol Sector

Route de la Mandchourie 25

2800 Delémont

- Tel.

- +41 58 462 65 00

- Fax

- +41 58 463 18 28