What goods are you allowed to import into Switzerland? When do you have to pay VAT and customs duties (tax-free limit and duty-free allowances)? Here you will find an overview of the regulations when entering Switzerland with goods.

Download the official FOCBS application and clear your goods with peace of mind before crossing the border. More

Direct links

Personal effects

Personal effects can be imported tax and duty-free. These include objects which:

- individuals resident in Switzerland took with them when they left the country;

- individuals resident abroad use during their stay in Switzerland and re-export.

This includes, for instance, items of clothing, underwear, toiletries, sports equipment, still and video cameras, mobile phones, laptops and musical instruments.

Personal travelling provisions

Travelling provisions can be imported tax and duty-free. These include ready-to-eat food and non-alcoholic beverages for the day of travel.

Please note: It is prohibited to bring in meat and dairy products, as well as most fruits and vegetables from third countries (i.e. non-EU countries). Check with the Federal Food Safety and Veterinary Office (FSVO) before you travel: Importation of foods by private travellers.

Other goods (souvenirs, foodstuffs, medicines etc.)

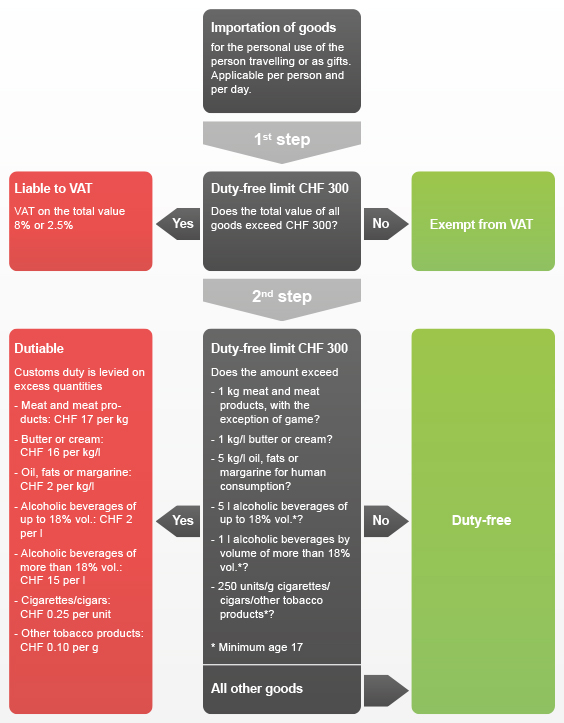

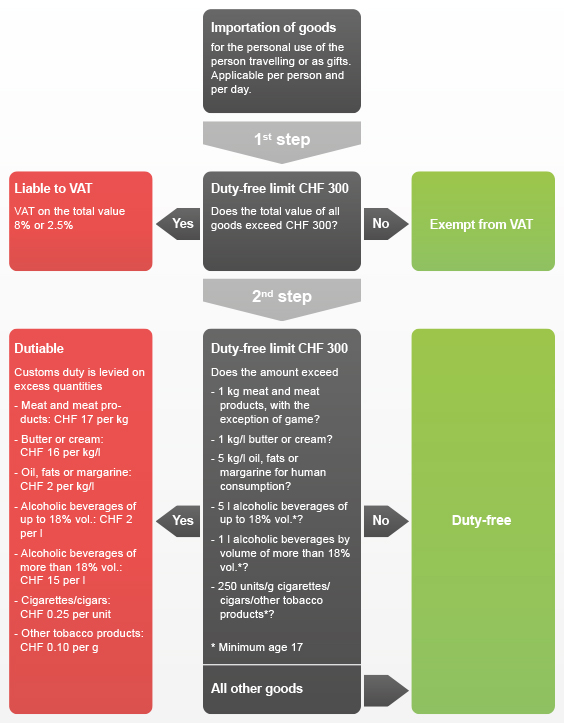

If you are importing goods (furniture, electronic items, car accessories, etc.), the following regulations apply:

- You pay VAT on goods with a total value of CHF 300 or more.

- You have to pay customs duties on certain goods and animals. You can find information on this via the links below, e.g. on foodstuffs, alcohol and tobacco.

Tax-free limit and duty-free allowances àat (PDF, 70 kB, 15.12.2021) a glance. - Prohibited items and restrictions: Certain goods are prohibited for importation or are subject to certain restrictions. These include, for example, certain species-protected plants, animals and goods, as well as counterfeits, weapons, pyrotechnic articles, medicines, cash, etc. More information

Further info

The full context is available in:

Customs info: essential information at a glance (PDF, 1 MB, 31.08.2023)With this brochure, we wish to help make your passage through Swiss Customs a smooth one. Are you familiar with our QuickZoll app?

Services